XRP Price Prediction: Breaking $3.12 Resistance as ETF Launch and Institutional Partnerships Drive Bullish Momentum

#XRP

- ETF Catalyst: First US spot XRP ETF nearing launch, creating institutional demand

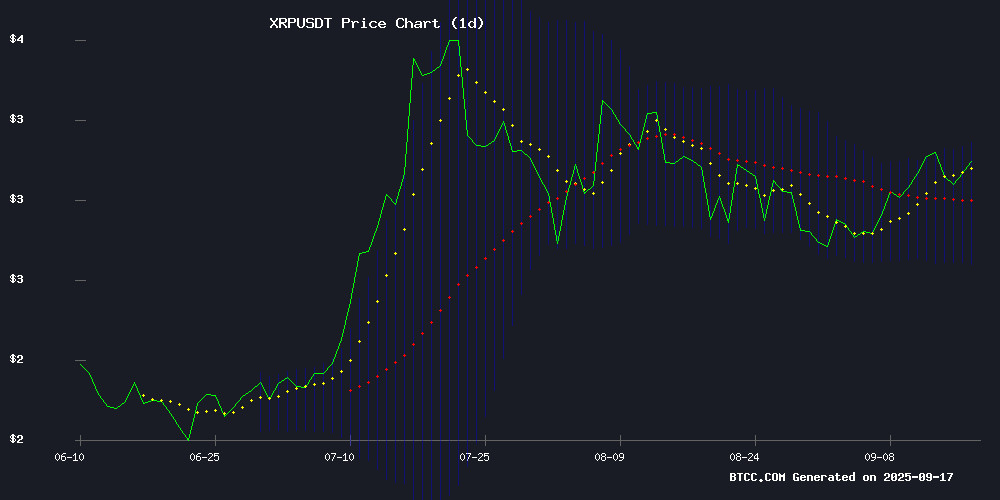

- Technical Breakout: Price above key moving averages with bullish Bollinger Band positioning

- Fundamental Support: Banking partnerships and 25% APY staking options providing additional value

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

XRP is currently trading at $3.072, positioned above its 20-day moving average of $2.9237, indicating underlying bullish momentum. The MACD reading of -0.0958 suggests some near-term weakness, but the price holding above the middle Bollinger Band at $2.9237 shows resilience. According to BTCC financial analyst Robert, 'The breakthrough above $3.00, combined with trading NEAR the upper Bollinger Band at $3.1548, suggests potential for further upside if bullish sentiment persists.'

Market Sentiment: ETF Developments and Partnerships Fuel XRP Optimism

Market sentiment for XRP appears strongly bullish driven by multiple catalysts. The imminent launch of the first US spot XRP ETF by REX-Osprey, combined with Ripple's partnership with BBVA, is generating significant institutional interest. BTCC financial analyst Robert notes, 'The convergence of regulatory progress, ETF anticipation, and high-yield staking options creating 25% APY is creating perfect conditions for sustained upward momentum. The $3.12 resistance level appears within reach given current market dynamics.'

Factors Influencing XRP's Price

XRP Nears $3.12 Resistance Amid ETF Buzz and Trader Optimism

XRP's price approaches a critical $3.12 resistance level as anticipation builds around the potential launch of an XRP-focused Exchange-Traded Fund (ETF). Market participants view this development as a catalyst for broader institutional adoption, echoing the trajectory of Bitcoin and Ethereum ETFs.

The introduction of an XRP ETF would mark a significant milestone, bridging the gap between traditional finance and digital assets. Institutional investors, previously wary of direct crypto exposure, may now gain regulated access—potentially driving demand and liquidity to new highs.

Analysts suggest sustained momentum could propel XRP beyond $4, contingent on favorable market conditions. This mirrors a growing trend of cryptocurrency integration into mainstream investment portfolios, with Bitcoin and Ethereum ETFs paving the way.

XRP Price Prediction: Bulls Eye Breakout Amid Fed Rate Cut Speculation and ETF Hype

XRP traders are positioning for a potential breakout as Federal Reserve rate cut expectations and ETF speculation fuel market optimism. Historical patterns suggest disproportionate gains for Ripple's native token during liquidity surges, with JPMorgan data showing XRP has historically amplified stock market rallies by 10x or more during similar macroeconomic conditions.

The Fed's impending policy shift looms large over risk assets. A dovish turn could channel capital into high-beta cryptocurrencies like XRP, replicating past cycles where the token outperformed equities by orders of magnitude. Market technicians note the current setup mirrors previous inflection points that preceded major XRP price appreciations.

First US Spot XRP ETF Nears Market as REX-Osprey Finalizes XRPR

The U.S. crypto investment landscape is on the verge of a significant development with REX-Osprey's imminent launch of the first exchange-traded fund (ETF) directly tied to XRP. The XRPR ETF will offer American investors regulated exposure to one of the largest digital assets by market capitalization, underscoring growing institutional interest in cryptocurrencies.

REX Shares confirmed on September 15 that the XRP-focused ETF is poised to begin trading soon. The fund, designed to mirror XRP's performance before fees and expenses, may also utilize financial derivatives like futures and swaps to maintain exposure in varying market conditions. This flexibility distinguishes it from traditional crypto ETF structures.

The regulatory approach taken by REX-Osprey is notable. By filing under the Investment Company Act of 1940—a departure from the more common Securities Exchange Act of 1933—the firm has carved a unique path to bring this product to market. The January 21, 2025 registration statement signals a strategic shift in how crypto investment vehicles navigate the U.S. regulatory framework.

US and UK Set to Seal Landmark Crypto Cooperation Deal

The United States and the United Kingdom are poised to announce a groundbreaking agreement on digital assets, with stablecoins taking center stage. High-level talks in London between UK Chancellor Rachel Reeves and US Treasury Secretary Scott Bessent included industry heavyweights like Coinbase, Circle, and Ripple, alongside traditional finance players such as Citigroup and Bank of America.

The accelerated negotiations followed pressure from crypto advocacy groups urging the UK government to prioritize blockchain in upcoming trade discussions. British officials view stablecoins as a gateway to enhanced liquidity for domestic firms, with transatlantic alignment expected to unlock new opportunities across digital asset markets.

Chancellor Reeves previously framed crypto regulation as pivotal during discussions with US Ambassador Warren Stephens, signaling its growing importance in capital markets integration. The deal underscores mounting institutional recognition of digital assets' role in global finance.

XRP Price Outlook for September 2025 Amid Market Neutrality

XRP trades at $2.83, showing minimal volatility with a 0.5% dip in the current session. The Relative Strength Index (RSI) at 49.54 reflects neutral market sentiment, while trading volume surges to $4.43 billion.

Despite a 7% monthly decline, analysts project a 12% rebound toward $2.91 in September, contingent on market stability. Short-term forecasts suggest a range-bound movement between $2.74 and $3.18.

The XRP Ledger's recent upgrade underscores Ripple's focus on enhancing its decentralized payment network for cross-border transactions. Technical indicators reveal a tentative uptick, with the 9-period EMA hovering near the current price at $2.84.

How Will XRP Price React After the FOMC Meeting Today?

The U.S. Federal Reserve's impending interest rate decision looms large over the crypto market, with XRP poised for potential volatility. Markets anticipate a 25 basis point cut to 4.25%, already priced in, but a deeper 50-point reduction could ignite rallies across risk assets. Liquidity injections from rate cuts typically buoy speculative assets—XRP's technical setup shows resistance at $3.10-$3.13, with upside potential toward $3.40 on a breakout.

Analysts warn that status quo rates may trigger bearish sentiment. The inverse head-and-shoulders pattern suggests accumulating momentum, though Fed policy remains the decisive catalyst. Crypto markets now trade as a levered bet on monetary policy—every basis point shift reverberates through altcoin order books.

XRP Price Breaks Above $3 as Ripple BBVA Partnership Drives Institutional Momentum

XRP surged past the $3 psychological barrier, currently trading at $3.02 despite a minor 24-hour pullback of 0.54%. The rally follows Ripple's landmark partnership with Spanish banking giant BBVA, announced September 10 under the EU's MiCA regulatory framework.

Institutional interest has surged, with Binance spot volumes hitting $243.5 million in 24 hours. Technical indicators show bullish momentum, with XRP's RSI at a neutral 53.18. The BBVA collaboration marks a watershed moment for blockchain adoption in traditional finance, particularly as European banks actively seek MiCA-compliant solutions.

First U.S. XRP ETF Set to Launch Amid Regulatory Scrutiny and Market Skepticism

REX-Osprey's XRP ETF (XRPR) is poised to debut this week, marking the first U.S. fund offering direct exposure to the third-largest cryptocurrency by market cap. The SEC-approved product will primarily track spot XRP performance, though it permits derivatives as supplementary instruments. Market observers remain divided, with some labeling the structure a regulatory loophole and others noting its hybrid nature—combining direct holdings with foreign ETF exposure.

XRP's price action stagnates near the $3.01–$3.05 support-resistance zone despite bullish catalysts: the nearing conclusion of the SEC lawsuit, inclusion in U.S. strategic crypto reserves, and political tailwinds from the Trump administration. The absence of a anticipated post-lawsuit price surge has left investors questioning XRP's next move.

TradingView charts reflect trader anxiety as the ETF news fails to ignite momentum. Bloomberg Intelligence suggests the launch may be a litmus test for crypto ETFs beyond Bitcoin and Ethereum, though skepticism persists about its immediate market impact.

XRP $1000 Prediction Gains Credibility Amid DeFi Growth and Divergent Analyst Views

XRP's potential to reach $1000 is gaining traction as XRP Tundra's DeFi platform outperforms Kaspa's growth, with early investors eyeing generational wealth. Jake Claver, CEO of Digital Ascension Group, projects a surge to $1,500–$2,000 by early 2026, citing macroeconomic shifts and institutional adoption. Others, like Pantoja, argue even $1000 will require more time, underscoring the debate around XRP's valuation.

XRP Tundra's Cryo Vaults offer holders yield opportunities, allowing XRP to be locked for 7–90 days in exchange for TUNDRA tokens. With a pre-allocated reward pool and tiered APYs up to 30%, the platform aims to avoid inflation. Frost Keys, NFT-style assets, further enhance yield strategies. Presale participants gain early access, blending speculative upside with tangible income potential.

XRP Tundra Launches 25% APY Staking Platform, Targeting Passive Income for XRP Holders

XRP Tundra has unveiled a staking platform offering up to 25% annual yield, addressing a long-standing gap in XRP's utility as a passive income generator. The project's Cryo Vaults allow token locking, while Frost Keys—NFT-based instruments—enable customizable lock-up terms and yield optimization.

The presale phase guarantees early access to staking functionality, combining capital appreciation potential with recurring yield. This dual-token model marks a strategic shift for XRP, traditionally valued solely for transactional efficiency.

Is XRP a good investment?

Based on current technical indicators and market developments, XRP presents a compelling investment opportunity. The cryptocurrency is trading above key technical levels with strong institutional momentum building through ETF developments and banking partnerships.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $3.072 | Above 20-day MA |

| 20-day MA | $2.9237 | Bullish support level |

| Upper Bollinger | $3.1548 | Near-term resistance |

| MACD | -0.0958 | Some near-term weakness |

BTCC financial analyst Robert emphasizes that 'the combination of technical strength, regulatory progress, and growing institutional adoption creates a favorable risk-reward scenario for medium to long-term investors.'